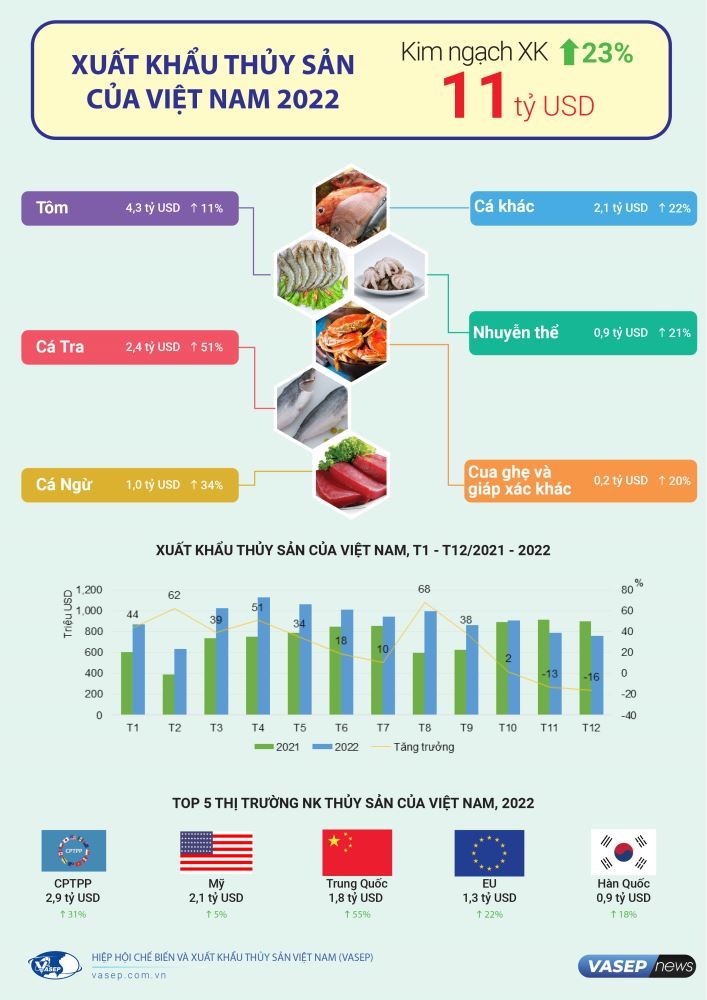

Seafood is a key export product for Vietnam. Every year, Vietnam's seafood exports bring in hundreds of millions of USD. According to VASEP, in December 2022, Vietnam's total seafood exports reached 785 million USD, continuing a decline of 13% from the same period in 2021. However, thanks to continuous growth in the first few months of the year, Vietnam's total seafood exports reached nearly 11 billion USD in 2022, up 23% from 2021. Let's take a look at the top 10 export markets for Vietnamese seafood in the first 11 months of 2022.

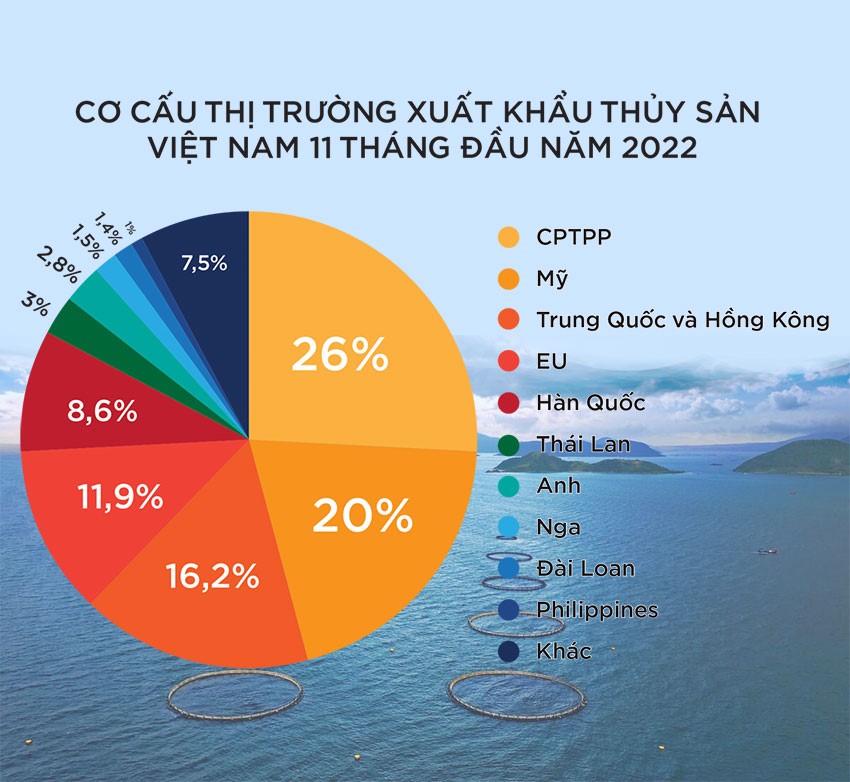

Estimated to reach 10.2 billion USD by the end of November 2022, Vietnam's seafood export exceeded expectations. In particular, the CPTPP countries are estimated to have reached nearly 2.66 billion USD, up 33.8% from the same period in 2021. Japan, a traditional market for Vietnam, with a value of 1.5-1.6 billion USD, has contributed to the dynamism of seafood trade between Vietnam and the CPTPP. If we look at the overall value of seafood in this bloc, we will not see a boom in growth in the past 4 years, as it still maintains a market share of 25-26%. However, if we consider each country and the main export items individually, there has been a clear increase.

Vietnam's seafood exports to the United States in the first 11 months of 2022 reached over 2 billion USD, up 9.6% from the same period last year. This is the first time that seafood exports to the United States have reached this figure, making the United States the largest single market for Vietnam's seafood exports, accounting for 20% of the total export value. The United States is also the number one market for Vietnamese shrimp, accounting for 19.1%. For catfish, the United States is the second market after China, accounting for 22.7%. For tuna, exports to the United States account for a dominant share of 48.6%.

In the first 11 months of 2022, Vietnam's seafood exports to China and Hong Kong reached 1.66 billion USD, up 64.9% from the same period last year. Many forecasts show that Chinese seafood consumption will recover, grow, and is expected to return to normal before the Spring Festival on January 22, 2023. In addition, China is abolishing strict COVID-19 import procedures; inspection and quarantine are no longer required for goods when they arrive at the port; this is a great opportunity for Vietnamese exports, especially seafood, to penetrate this large market in 2023.

According to VASEP statistics, in the first 11 months of 2022, the EU27 market accounted for nearly 12% of the value of Vietnam's seafood exports, ranking fourth after the CPTPP, the United States, China, and Hong Kong. In the picture of exports worth 10.2 billion USD with all green growth in the first 11 months of 2022, the EU market also contributed a bright color with a value of over 1.22 billion USD, up 26.3% from the same period in 2021. Currently, Vietnam has nearly 1,000 businesses that have EU code in the EU, this is a major certificate for us to penetrate and conquer other markets. In addition, we also have a price advantage, especially catfish with a price advantage of 50% and benefit from free trade agreements, especially the EVFTA. However, the major challenge in this market is still the “puzzle” of IUU fishing activities.

Vietnam's seafood exports to South Korea are expected to grow in the coming years, as the South Korean market is a promising destination for Vietnamese seafood. In the first 11 months of 2022, Vietnam's seafood exports to South Korea reached over 877 million USD, up 21.6% from the same period last year, accounting for 8.6% of Vietnam's total seafood export value. The main seafood export items to this market are shrimp, squid, octopus, and tuna...To boost exports to South Korea, Vietnamese seafood products must ensure the following factors: quality, taste, stability in production, processing, and distribution, food safety, and safety in processing and distribution. It is also important for Vietnamese and South Korean businesses to build trust and credibility in their dealings with each other.

In 2022, in addition to the Chinese market, ASEAN countries, including Thailand, also had a strong attraction for Vietnamese seafood exporters. Accordingly, Vietnam's seafood exports to Thailand in the first 11 months of 2022 reached over 306 million USD, up 27.2% from the same period last year. In 2023, it is forecast that Thailand's special domestic factors could create optimism for domestic businesses as well as foreign exporters such as Vietnam. The two main growth drivers are the recovery of tourism and economic stimulus after the election, which is expected to boost domestic consumption.

Specifically, the Thai government is expected to implement a number of measures to stimulate the economy, including tax cuts, investment incentives, and infrastructure spending. These measures are expected to boost consumer spending, which will create demand for seafood.

In addition, the recovery of tourism is also expected to benefit the Thai seafood industry. Thailand is a popular tourist destination, and the return of tourists will create demand for seafood products, such as seafood dishes and seafood souvenirs.

Overall, the outlook for Vietnam's seafood exports to Thailand in 2023 is positive. The recovery of tourism and economic stimulus are expected to boost domestic consumption, which will create demand for seafood.

Britain currently holds the seventh position in the top 10 seafood export markets of Vietnam, accounting for 2.8% of the total export value. As of November 2022, Vietnam's seafood exports to the UK reached over 290 million USD, up 1.1% from the same period last year. Vietnam's seafood exports to the UK market are seeing many positive and favorable signs, especially in terms of tariffs. With the Vietnam-UK Free Trade Agreement (UKVFTA), Vietnam's seafood exports to the UK continue to enjoy the benefits based on the EVFTA continuation mechanism.

Specifically, under the UKVFTA, all tariffs on Vietnam's seafood exports to the UK will be eliminated within three years, except for a few items that will be eliminated within seven years. This will significantly reduce the cost of Vietnamese seafood exports to the UK, making Vietnamese seafood more competitive in the UK market.

In addition, the UKVFTA also provides for a number of other benefits for Vietnamese seafood exporters, such as improved market access, reduced trade barriers, and enhanced cooperation in the field of fisheries. These benefits are expected to help Vietnamese seafood exporters expand their market share in the UK.

Overall, the outlook for Vietnam's seafood exports to the UK is positive. The UKVFTA is expected to provide a significant boost to Vietnamese seafood exports to the UK.

As of November 2022, Vietnam's seafood exports to Russia increased by 2.4%, reaching over 154 million USD. In 2022, six more Vietnamese businesses were granted export licenses for seafood to Russia, bringing the total number of businesses allowed to export seafood to Russia to 54. With tariff benefits under the Vietnam-Eurasian Economic Union Free Trade Agreement (VN-EAEU FTA), many Vietnamese agricultural and seafood products are currently highly competitive in this economic market.

Specifically, under the VN-EAEU FTA, all tariffs on Vietnam's seafood exports to Russia will be eliminated within seven years, except for a few items that will be eliminated within 10 years. This will significantly reduce the cost of Vietnamese seafood exports to Russia, making Vietnamese seafood more competitive in the Russian market.

In addition, the VN-EAEU FTA also provides for a number of other benefits for Vietnamese seafood exporters, such as improved market access, reduced trade barriers, and enhanced cooperation in the field of fisheries. These benefits are expected to help Vietnamese seafood exporters expand their market share in Russia.

Overall, the outlook for Vietnam's seafood exports to Russia is positive. The VN-EAEU FTA is expected to provide a significant boost to Vietnamese seafood exports to Russia.

In 2022, Taiwan became one of the top 10 seafood export markets for Vietnam. As of November 2022, seafood exports to Taiwan reached over 145 million USD, up 44.6% from the same period last year. Of these, shrimp exports reached 30.8 million USD; catfish exports reached over 33.3 million USD; and other seafood products reached 22.7 million USD...Although the amount of seafood exports from Vietnam to this market is still not high, many experts believe that businesses need to pay more attention to it and have a suitable approach to exploiting this market. This is because, despite being a small market, the standards are not very strict. In addition, diversifying markets will greatly help the long-term goal of sustainable development of the seafood industry that the industry is aiming for.

The Philippines market has seen a remarkable transformation, from 23rd place in 2020 to 13th place in 2021 and 10th place among Vietnam's top seafood export markets in 2022. In the first 11 months of 2022, the Philippines was one of the markets with strong growth in seafood imports from Vietnam, with a turnover of over 101 million USD, up 30.8% from the same period last year. In the context of seafood exports to some major markets facing many difficulties in 2023, expanding exports to many niche markets, such as the Philippines, is a direction that many businesses need to pay attention to.